f you will be not able to rating a consumer loan because of an effective terrible otherwise minimal credit score, you’ll be able to inquire you to definitely try to be a great guarantor to your obligations.

By doing this, you could submit an application for an effective guarantor financing, having one minute people agreeing become guilty of the debt if you’re unable to keep up personal installment loans for poor credit New Castle with payments.

What’s a great guarantor financing?

An excellent guarantor mortgage is a type of unsecured consumer loan you to definitely enables you to borrow cash when you have zero, nothing, otherwise a dismal credit history. A portion of the difference between these types of or any other types of credit was which they require a 3rd party, the latest guarantor, in order to invest in help and then make the new money for many who cannot get it done.

Guarantor loans normally incorporate high annual percentage rates (APRs) than simply fundamental unsecured loans, as they are geared towards consumers which have stained borrowing from the bank histories. But as with any loan, the speed you will get relies on your very own situations.

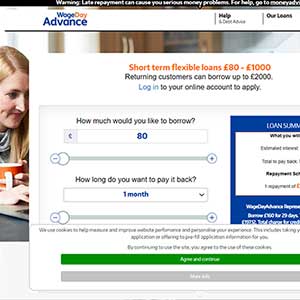

Faster, specialist loan providers usually provide guarantor finance, and are generally typically considering on the web by the providers. You’ll find a knowledgeable unsecured loans to you that with a comparison services. This can make you an overview of the market, while the types of pricing you can aquire.

Simply how much would you obtain?

The total amount you could obtain is determined by enough affairs, and, your own situations, things about taking out the borrowed funds, credit rating, together with your total financial predicament (together with one most recent bills).

You may be given lower than you in the first place requested, oriented how much the financial institution believes your, plus guarantor, find the money for pay-off. But, generally speaking, requests for borrowing vary from ?1,one hundred thousand and you can ?fifteen,one hundred thousand.

Exactly what do make use of a guarantor loan to possess?

As with unsecured loans, a guarantor loan would be used for many explanations, also home improvements or buying a car. As ever, you might want to look at your things about taking on people personal debt, especially if you will get struggle to satisfy payments. In such a case, would certainly be better off in search of help to control your funds.

Whilst you wouldn’t need a good otherwise expert credit score to help you take out a beneficial guarantor financing, you will have to assist you are able brand new money because element of their outgoings. Thus, consider what you could its afford to pay back each month in advance of trying to get that loan.

- When you have a poor credit score and require financing to possess a certain reasoning, guarantor funds will be the proper selection for you.

- You are able to acquire more funds than simply you would having a basic unsecured unsecured loan, based your state.

- Given you create your instalments on time, taking right out that loan may offer a way to raise an excellent poor credit records.

- You may also spend a top interest to own good guarantor financing than for a standard unsecured loan.

- Your reference to the latest guarantor may suffer if you can’t build repayments and feel responsible for your debt and you may money.

- For folks who sign up to feel a great guarantor and stay responsible to your financial obligation, this may absolutely impact your financial situation. Especially if you, also, struggle to fulfill payments.

That is brand new guarantor?

A guarantor is actually, usually, somebody aged more 21 and close to you eg an excellent family member or friend having each other a credit score and you may a United kingdom bank account. He/she must be within the an effective enough financial situation to meet up costs, if required to achieve this. This can be reviewed from inside the software techniques.

Exactly what are the dangers of being a guarantor?

The fresh guarantor try prepared to enter into a lawfully binding relationship to fulfill repayments in your stead if you can’t perform thus, and may understand the responsibilities and you may dangers this calls for.

It is vital to take the implications to be an effective guarantor definitely, and there is potential effects for many who become liable for money in addition to total debt. What if your role altered, or you forgotten your job? For those who discover your self economically pushed, could you not be able to meet with the payments? Your credit score you will suffer and you may actually face legal procedures regarding completely new bank getting a loans.

You need to simply donate to becoming a beneficial guarantor when you’re certain you will be at ease with the brand new plan, and its own implications to you along with your connection with the fresh new debtor.

Read more

- How exactly to submit an application for a consumer loan

- Best consumer loan rates

- Shielded instead of unsecured loans

- Simple tips to drive from for the better car loan